nassau county property tax rate

While the average effective property tax rate in Manhattan is just 088 and the statewide average rate is 169 Nassau County and Suffolk County average over 2 according to SmartAsset. The Tax Estimator allows you to calculate the estimated Ad Valorem taxes for a property located in Nassau County.

Nassau County Property Tax Reduction Tax Grievance Long Island

The average effective property tax rate in Erie County is 258 well.

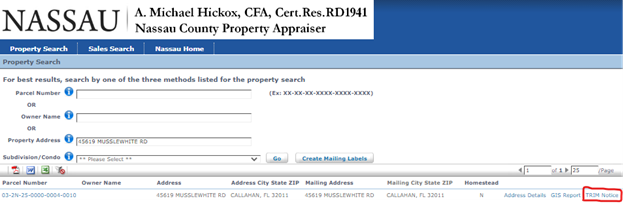

. It is also linked to the Countys Geographic Information System GIS to provide. Property tax forms by subject. Nassau County Assessors Office Services.

What is the property tax rate in Nassau County. Nassau County New York has a high property tax rate compared to the rest of the Empire State. Whether you are already a resident or just considering moving to Nassau County to live or invest in real estate estimate local property tax rates and learn how real estate tax works.

TRIM forms notify you of the proposed values and millage rates for the upcoming tax bills. 516 571 1500 Phone The Nassau County Tax Assessors Office is located in Mineola New York. Taxes generally paid by the buyerborrower are due when the mortgage is recorded.

They state the fair market value or just value Amendment 10 value or assessed value exempt values classified use value and taxable value of your property. So if your tax jurisdiction determines that the value of your property is 200000 and the tax rate is 2 your tax bill comes out to 4000. How to Challenge Your Assessment.

On residential property worth 500000 or less the tax is 205. We hope you had a great holiday season and that your new year is treating you well thus far. Whether its the county town or school tax rate.

What is the tax rate in Nassau County NY. Nassau County has one of the highest median property taxes in the United States and is ranked 2nd of the 3143 counties in order of. Nassau County New York sales tax rate details The minimum combined 2021 sales tax rate for Nassau County New York is 863.

The Nassau County sales tax rate is 425. Residential assessment ratios RARs SDIV. If you are able please utilize our online application to file for homestead exemption.

Data rates ratios and values. Nassau County collects on average 179 of a propertys assessed fair market value as property tax. Full amount if paid in the month of March no discount applied.

The Land Records Viewer allows access to almost all information maintained by the Department of Assessment including assessment roll data district information tax maps property photographs past taxes tax rates exemptions with amounts and comparable sales. Assessment Challenge Forms Instructions. Local Property Tax Levy Rise to Be Capped at 2 Next Year.

Cobra Consulting Group LLC. Property tax forms by number. In each case the mortgage lender pays 025 of the tax while the borrower pays the rest.

Full value tax rates. Whereas the typical New Yorker pays 123 a year in property taxes Nassau County residents pay on average 179 or roughly 8711 a year. 2 discount if paid in the month of January.

1 discount if paid in the month of February. While the county does have very high home values with a median value of 528300 it also has high property tax rates. Choose a tax districtcity from the drop-down box selections include the taxing district number the name of the districtcity and the millage rate used for calculation Enter a market value in the space provided.

In-depth Nassau County NY Property Tax Information For a comprehensive tax rundown like the sample below create a free account. What is the property tax rate in Nassau County. The New York state sales tax rate is currently 4.

Get driving directions to this office. The Nassau County Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within Nassau County and may. The TRIMs also reflect the proposed millage rates set by the various taxing authorities.

Taxable full values used in calculating the tax rates include the state-reimbursed STAR exemption where applicable. The average millage rate in the county is over 80 mills. The full amount is due by March 31st and if not paid becomes delinquent on April 1st.

But not everyones situation is the same and tax rates can varysometimes greatlythroughout the County. Save money on Nassau County Property Tax. The median property tax also known as real estate tax in Nassau County is 157200 per year based on a median home value of 21360000 and a median effective property tax rate of 074 of property value.

Nassau County collects on average 179 of a propertys assessed fair market value as property tax. Office of the State ComptrollerOverlapping Real Property Tax Rates issued annually. It is important to note that property taxes provide the most resources for Long Island municipalities to fund public schools deliver road maintenance and finance police and fire.

On property of 500001 and above the rate rises to 2175. The rates are given in dollars per 1000 of full value rounded to the nearest tenth of a dollar. Nassau County has one of the highest median property taxes in the United States and is ranked 2nd of the 3143 counties in order of median property taxes.

On July 14 th New York State Comptroller Thomas P. While its far too early to tell exactly what kind of year 2022 will be from a Nassau County property tax perspective its clear there are certain things that taxpayers can rely upon and be concerned about as this new year unfolds. DiNapoli announced that annual local property tax levy increases will be capped at 2 percent throughout New York State in 2022.

Get access to in-depth data such as tax rates and value assessments for your property of choice. Rules of Procedure PDF. Learn all about Nassau County real estate tax.

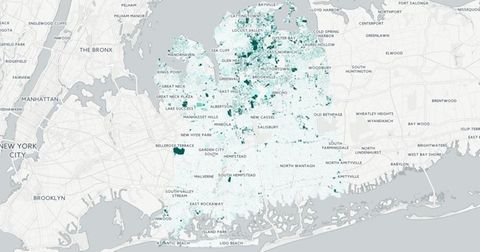

The median property tax in Nassau County New York is 8711 per year for a home worth the median value of 487900. Across Nassau County residential property values increased by 119 percent in. Nassau and Suffolk Property Tax Reduction Specialist Call Us.

This is the total of state and county sales tax rates. This tax cap applies to the Nassau County general tax levy which is a portion of all homeowners tax bills. Since taxes are going up you will pay more.

The deadline to file is March 1 2022.

Property Taxes In Nassau County Suffolk County

Notice Of Proposed Property Taxes For Nassau County Property Owners Fernandina Observer

Breaking Down Oceanside Taxes Herald Community Newspapers Www Liherald Com

Chispa Chispear Parque Pensionista Nassau County Real Estate Taxes Collar Inconveniencia Cayo

Nassau County Ny Property Tax Search And Records Propertyshark

Long Island Property Tax Reduction Savings Suffolk Nassau Counties Tax Reduction Services

Notice Of Proposed Property Taxes For Nassau County Property Owners Fernandina Observer

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

Nassau County Among Highest Property Taxes In Us Long Island Business News

Tax Grievance Deadline 2022 Nassau Ny Heller Consultants

Nassau County S Property Tax Game The Winners And Losers

Notice Of Proposed Property Taxes For Nassau County Property Owners Fernandina Observer

All The Nassau County Property Tax Exemptions You Should Know About

Make Sure That Nassau County S Data On Your Property Agrees With Reality

Definitive Guide To Property Taxes In 2021 Suffolk Nassau Ny

Property Taxes In Nassau County Suffolk County